What is Financial Freedom and Why It Matters in Today’s World

Financial prosperity is not just about collecting wealth; it is about freedom from money worries. To define financial freedom in simple terms, it means having enough savings, assets, and income to support your lifestyle without depending on a job. It is the point where money no longer controls your decisions — instead, you control how money is used.

Why Financial Freedom Matters in Today’s World

The question is: why financial freedom matters in today’s world. With uncertain markets, rising costs, and unstable jobs, financial freedom brings stability. It provides peace of mind, helps you face unexpected challenges, and gives you the confidence to take opportunities without fear of money problems.

The Difference Between Financial Independence & Financial Freedom

It is also important to know the difference between financial independence and financial freedom. Independence means covering your basic needs through savings or passive income, without relying on a paycheck. Freedom goes further — it offers security, flexibility, and the ability to follow your passions without sacrifice. Independence gives sufficiency, while freedom creates abundance — a life shaped by choice, not by necessity.

True financial freedom is not about luxury; it is about strength and control. It is building a future where money is no longer a limit.

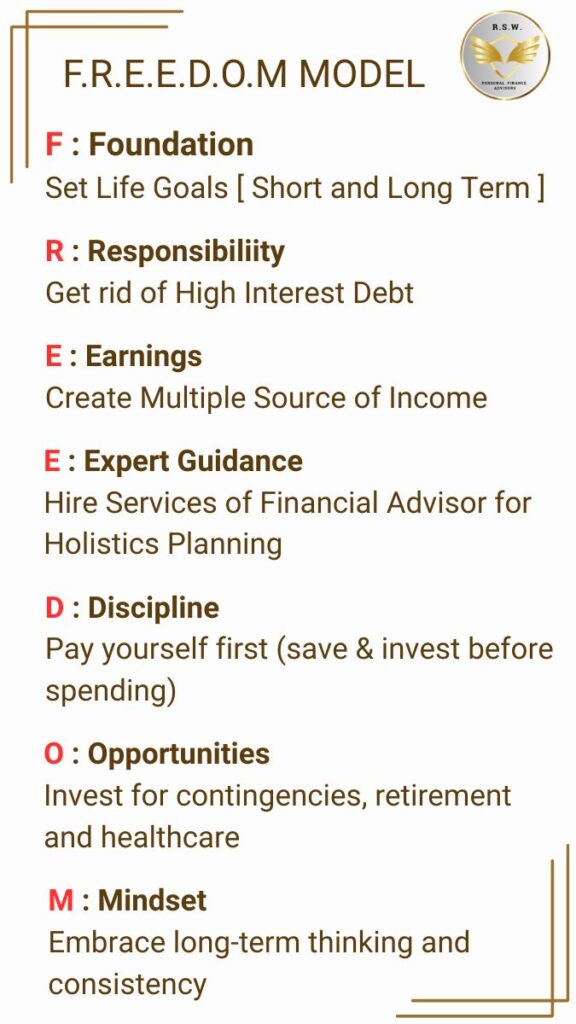

Simple Steps for Financial F.R.E.E.D.O.M

Stages of Life and Financial Freedom Planning

1. Early Career (20s – Early 30s)

Characteristics: First job, limited income, high aspirations, exposure to debt (education loans, credit cards).

Simple Actions for Financial Freedom:

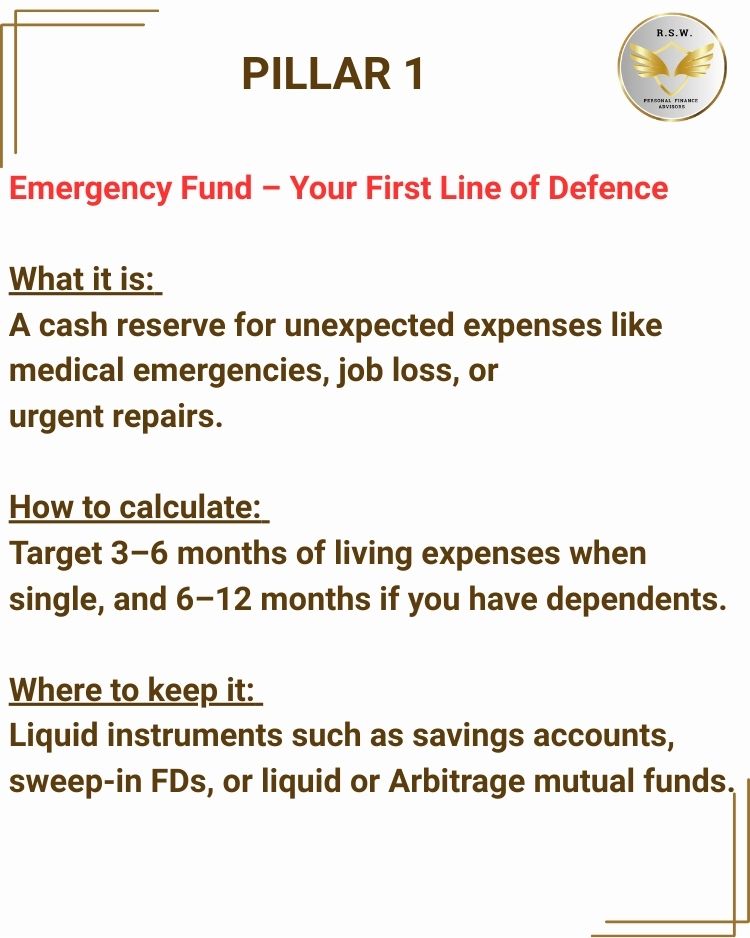

- Build an emergency fund (3–6 months of expenses).

- Avoid high-interest debt; pay credit cards in full.

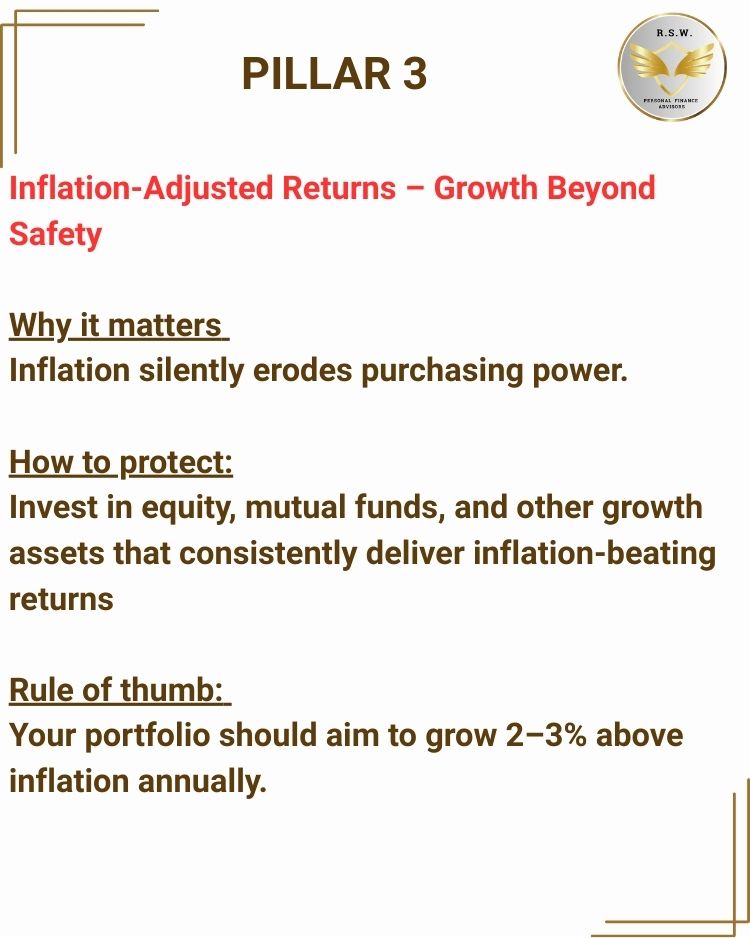

- Start investing early (mutual funds, retirement accounts).

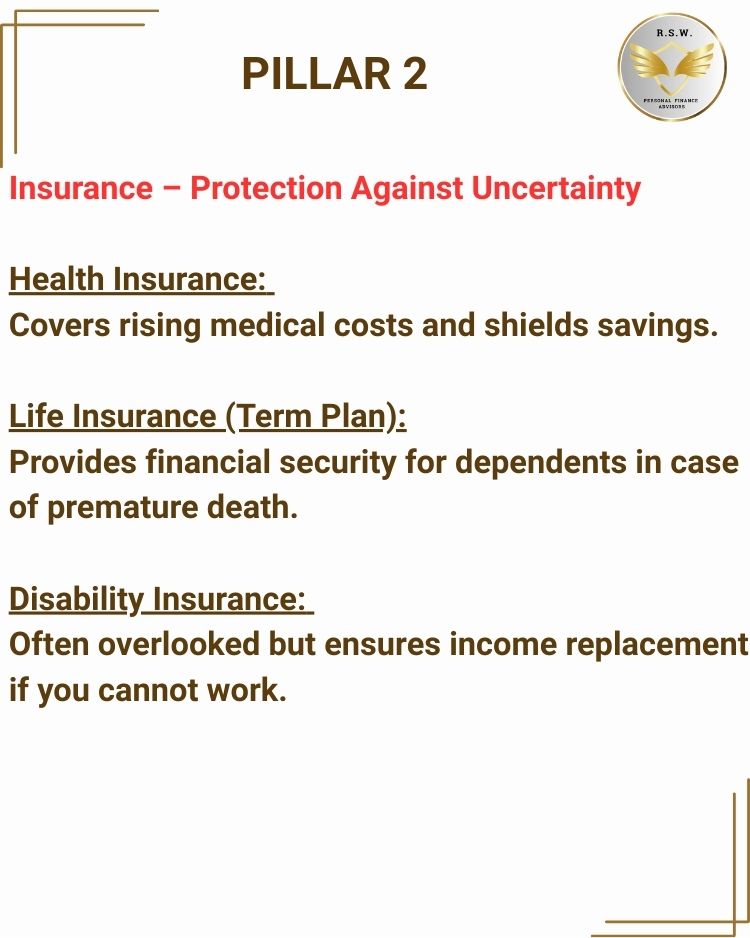

- Buy essential health and term insurance.

- Focus on skill development to increase income.

2. Mid-Career (30s – Early 40s)

Characteristics: Higher earnings, family responsibilities, home loans, children’s education.

Simple Actions for Financial Freedom:

- Expand emergency fund to cover 6–12 months of expenses.

- Continue SIP investments for wealth creation.

- Create a family protection plan (life insurance, health insurance for dependents).

- Start saving for children’s education and higher goals.

- Avoid lifestyle inflation; live below means despite rising income.

3. Peak Earning Years (40s – Early 50s)

Characteristics: Highest income years, multiple financial commitments, but also opportunity for serious wealth building.

Simple Actions for Financial Freedom:

- Aggressively repay debts (home, education).

- Maximise retirement contributions (EPF, NPS, mutual funds).

- Diversify investments into equity, debt, and real estate.

- Review and update estate planning (will, nomination, trusts).

- Protect against health risks with adequate insurance coverage.

4. Pre-Retirement (50s – Early 60s)

Characteristics: Debt should be nearly eliminated, retirement planning takes priority.

Simple Actions for Financial Freedom:

- Focus on capital preservation along with growth.

- Rebalance portfolio to reduce risk exposure.

- Build retirement corpus that can generate passive income.

- Plan healthcare contingencies (medical insurance, long-term care).

- Prepare for succession: wills, trusts, and wealth transfer structures.

5. Retirement (60s – 70s)

Characteristics: No active employment, reliance on retirement corpus and passive income.

Simple Actions for Financial Freedom:

- Create a monthly withdrawal strategy from retirement funds.

- Rely on low-risk, income-generating investments (annuities, bonds, dividend-paying funds).

- Maintain liquidity for medical and lifestyle needs.

- Simplify financial portfolio for ease of management.

- Ensure estate planning documents are in place and updated.

6. Legacy Stage (70s and Beyond)

Characteristics: Focus shifts from accumulation to preservation and transfer of wealth.

Simple Actions for Financial Freedom:

- Ensure financial independence without relying on children.

- Consolidate assets and simplify accounts.

- Regularly review estate plan (will, trust, nominations).

- Consider charitable giving or philanthropy if aligned with values.

- Communicate clearly with family to avoid disputes

Core Principles of Financial Freedom

Add Link to ” Why maintain Emergency fund in Arbitrage Mutual Funds ”

Also Read ” Health Insurance : Necessary even if you are covered under Group Health Insurance by your company ”

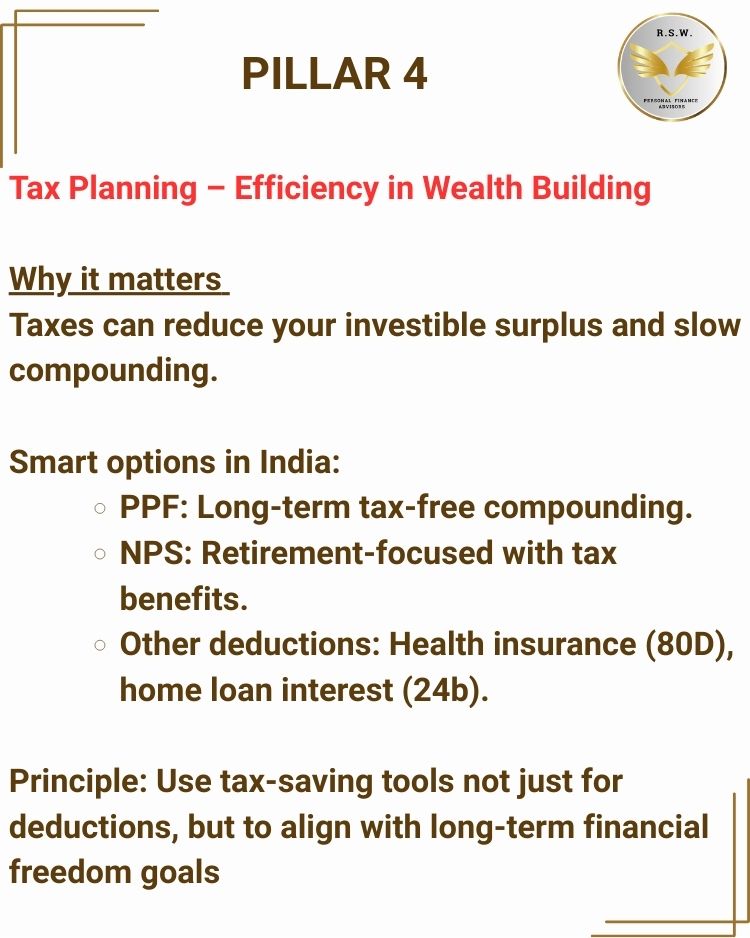

Also Read : ” PPF : An must have investment for a Truly Diversified Portfolio ”

Also Read : NPS : An Essential investment.